How Extra Mortgage Payments Save You Thousands

Table of Contents

- Why Extra Payments Are So Powerful

- The Impact of $100 Extra per Month

- Savings by Amount: $100 to $1,000/Month

- 7 Strategies for Making Extra Payments

- Lump Sum vs Monthly Extra Payments

- The Bi-Weekly Payment Strategy

- When NOT to Make Extra Payments

- How to Apply Extra Payments Correctly

- Extra Payments and PMI Removal

- Common Mistakes to Avoid

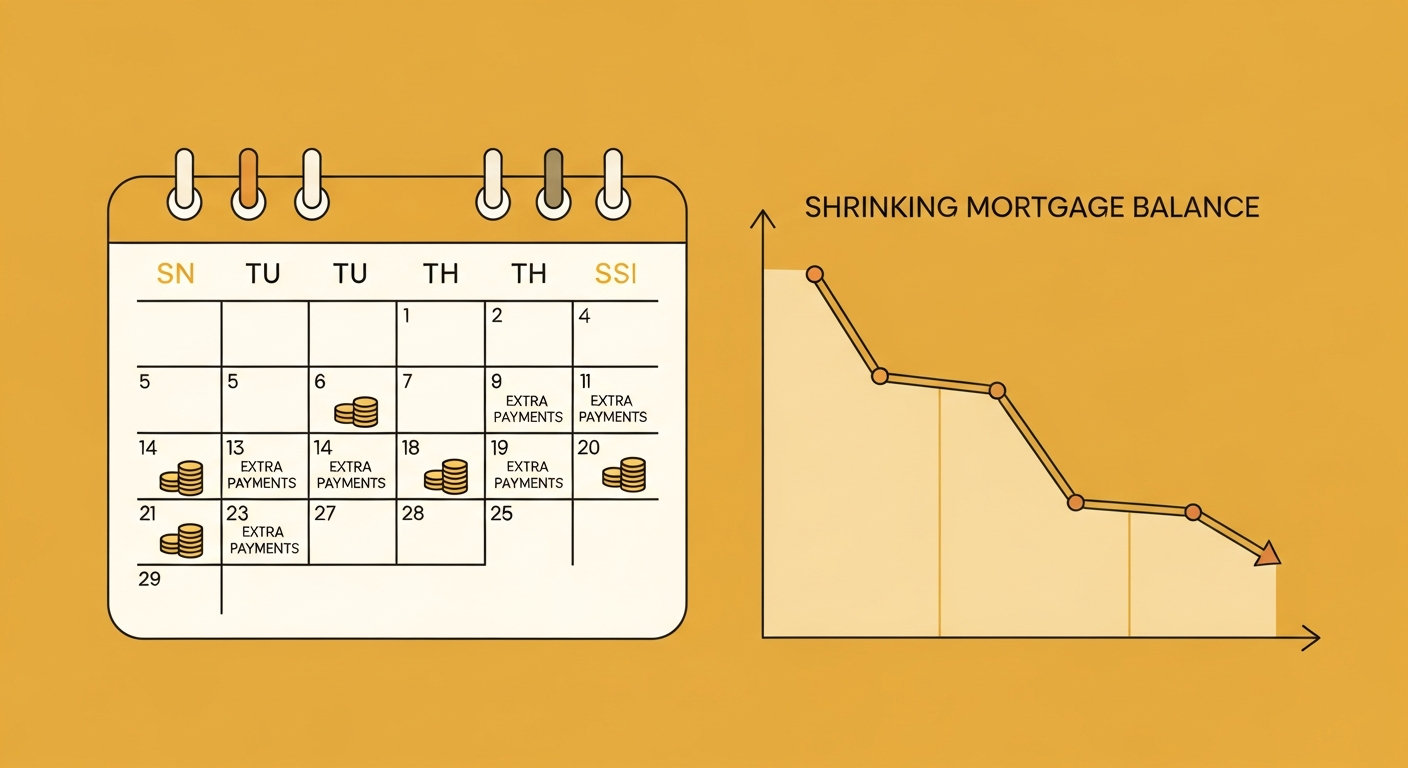

Why Extra Payments Are So Powerful

Here's the secret most homeowners don't realize: when you make an extra payment on your mortgage, 100% of that extra amount goes directly to reducing your principal. None of it goes to interest. This is fundamentally different from your regular payment, where a large portion goes to interest — especially in the early years of your loan.

To understand why this matters, consider how your regular payment works. In month 1 of a $350,000 loan at 6.75%, your payment of $2,270 breaks down like this: $1,969 goes to interest and only $301 goes to principal. That means 87% of your first payment is pure profit for the bank. By contrast, every dollar of an extra payment goes straight to reducing what you owe.

By reducing your principal faster, you lower the balance that future interest is calculated on. It creates a compounding effect — each extra dollar you pay now saves you multiple dollars in interest over the remaining life of the loan. The earlier you start, the more dramatic the savings because there's more time for the compounding to work.

The CFPB notes that making even small extra payments consistently is one of the most effective ways to build equity faster and reduce your total interest costs. It's essentially a guaranteed, risk-free return on your money equal to your mortgage interest rate.

The Impact of $100 Extra per Month

Let's look at a concrete example. You have a $350,000 loan at 6.75% for 30 years. Your standard monthly P&I payment is $2,270.

• Pay off in 26 years instead of 30 — 4 years early

• Save approximately $55,800 in total interest

• Total extra paid: $31,200 over 26 years

• Net savings: $24,600 (that's a 79% return on your extra payments)

Read that again: you invest $31,200 in extra payments over 26 years, and you save $55,800 in interest you would have paid. That's a better return than most investments, and it's completely risk-free. Plus, you own your home free and clear four years sooner — no more monthly mortgage payment consuming $2,270 of your income.

Now consider $100/month is just $3.33 per day. Skip one coffee shop visit, cancel one unused subscription, bring lunch from home twice a week — and you save over $55,000. When you frame it that way, extra mortgage payments become one of the most accessible wealth-building strategies available.

Savings by Amount: $100 to $1,000/Month

Here's a comprehensive breakdown on a $350,000 loan at 6.75%, 30-year term (regular P&I: $2,270/month, total interest without extra payments: $467,200):

| Extra/Month | Payoff Time | Years Saved | Interest Saved | Total Extra Paid |

|---|---|---|---|---|

| $50 | 28 years | 2 years | $30,400 | $16,800 |

| $100 | 26 years | 4 years | $55,800 | $31,200 |

| $200 | 23.5 years | 6.5 years | $96,400 | $56,400 |

| $300 | 21.5 years | 8.5 years | $126,700 | $77,400 |

| $500 | 19 years | 11 years | $168,900 | $114,000 |

| $750 | 16.5 years | 13.5 years | $201,300 | $148,500 |

| $1,000 | 14.5 years | 15.5 years | $226,200 | $174,000 |

The pattern is clear: every level of extra payment delivers substantial savings. Even a modest $50/month saves over $30,000. And at the $500/month level, you cut your loan term nearly in half and save $168,900 — almost half the original loan amount.

Notice how the return diminishes slightly as amounts increase. The first $100 saves $55,800 ($558 saved per dollar extra). Going from $500 to $1,000 extra saves an additional $57,300 for $60,000 more invested. The biggest bang for your buck comes from the first few hundred dollars of extra payments.

7 Strategies for Making Extra Payments

You don't have to write a separate check every month. Here are practical, proven ways to make extra payments without feeling the pinch:

- Round up your payment: If your payment is $2,270, round up to $2,400 or $2,500. That extra $130–$230/month is painless because it doesn't feel like a separate decision — it's just your "mortgage payment." On a $350,000 loan, rounding up to $2,500 ($230 extra) saves about $105,000 in interest.

- Bi-weekly payments: Instead of 12 monthly payments, make 26 half-payments (every two weeks). This equals 13 full payments per year — one extra payment annually without budgeting for it. On a $350,000 loan at 6.75%, this saves approximately $62,000 and cuts 4.5 years off your loan. See the bi-weekly section below for details.

- Annual bonus or tax refund: Apply your annual bonus or tax refund directly to your mortgage principal. A single $3,000 extra payment in year 3 of a 30-year loan can save over $10,000 in interest. The average American tax refund is about $2,800 — that's a potential $9,000+ savings every time you redirect it to your mortgage.

- Raise-based increases: Got a 3% raise? Increase your mortgage payment by half that amount. If you earn $80,000 and get a $2,400/year raise, adding $100/month to your mortgage means you still take home more money AND build equity faster. You won't notice the lifestyle difference.

- Automate it: Set up an automatic extra payment so you don't have to think about it each month. Behavioral finance research shows that automated savings dramatically outperform manual ones because willpower isn't required.

- The "found money" rule: Any unexpected income — garage sale proceeds, gift money, freelance payments, rebates — goes straight to the mortgage. These irregular windfalls add up surprisingly fast over the years.

- Cancel and redirect: Audit your monthly subscriptions. The average American spends $219/month on subscriptions. Cancel $100 worth of services you barely use and redirect it to your mortgage. You'll save $55,800 in interest and won't miss that streaming service you watched twice last year.

Lump Sum vs Monthly Extra Payments

Both approaches work, but timing matters significantly. A $5,000 lump sum payment in year 2 of your mortgage saves more interest than the same $5,000 paid in year 20 — because it has more time to compound its effect on your balance.

Here's the comparison on our $350,000 at 6.75% loan:

| Timing of $5,000 Lump Sum | Interest Saved | Return on $5,000 |

|---|---|---|

| Year 2 | $16,200 | 224% |

| Year 5 | $13,500 | 170% |

| Year 10 | $9,800 | 96% |

| Year 15 | $6,500 | 30% |

| Year 20 | $4,100 | -18% (still saves, but less) |

| Year 25 | $1,800 | -64% |

The takeaway is clear: the earlier you make extra payments, the more powerful they are. A $5,000 payment in year 2 is worth $16,200 — more than three times the original amount. The same payment in year 25 saves only $1,800.

However, consistent monthly extra payments often outperform lump sums in practice because most people find it easier to budget $200/month than to save up $5,000 at once. The best strategy is the one you'll actually stick with. If you have a lump sum available now, pay it immediately. Then layer on consistent monthly extras going forward.

The Bi-Weekly Payment Strategy

Bi-weekly payments are one of the most popular extra payment strategies because they feel almost invisible to your budget. Here's how it works:

- Instead of paying $2,270 once per month, you pay $1,135 every two weeks

- There are 52 weeks in a year, so you make 26 half-payments = 13 full payments

- That's one extra full payment per year ($2,270) without any conscious effort

On our $350,000 loan at 6.75%:

- Standard monthly: Paid off in 30 years, total interest $467,200

- Bi-weekly: Paid off in 25.5 years, total interest $405,200

- Savings: 4.5 years early and $62,000 in interest

Important caveat: Not all lenders support true bi-weekly payments. Some third-party services charge $300–$500 to set this up — which is unnecessary. Instead, simply divide your monthly payment by 12 and add that amount as extra principal each month. In our example: $2,270 ÷ 12 = $189 extra per month. Same result, no setup fees.

When NOT to Make Extra Payments

Extra mortgage payments aren't always the best use of your money. Consider holding off if:

- You have high-interest debt: If you're carrying credit card debt at 18%–25% APR, pay that off first. Paying $200 extra on a 6.75% mortgage while carrying $200 in credit card debt at 22% is losing you money. Always attack highest-rate debt first.

- You lack an emergency fund: Financial experts recommend 3–6 months of expenses in liquid savings before aggressively paying down your mortgage. Equity in your home isn't easily accessible in an emergency — you can't swipe your house equity at the grocery store. If your furnace dies or you lose your job, cash is king.

- Your employer matches 401(k) contributions: A 100% employer match is an instant 100% return. If your employer matches up to 6% and you're only contributing 3%, the extra 3% you put in is doubled immediately. No mortgage payment can beat that. Max out your match before making extra mortgage payments.

- Your mortgage rate is very low: If you locked in a rate of 3%–4% during 2020–2021, you may earn more by investing the extra money in index funds (historically 8%–10% average annual returns). At a 3.5% mortgage rate, the guaranteed return from extra payments is relatively modest compared to potential investment gains.

- You're saving for a specific near-term goal: If you need $20,000 for a child's college in 3 years, that money should be in a liquid savings account — not locked up in home equity.

For most homeowners with rates above 5%, extra mortgage payments are an excellent guaranteed return. For a broader view of your mortgage math, see our amortization schedule guide.

How to Apply Extra Payments Correctly

This is critical — and getting it wrong can waste your extra payments entirely. You must specify that extra payments go toward principal only. If you don't, some lenders will apply the extra amount to your next month's payment (which includes interest), or advance your due date without reducing your principal.

- Online payments: Most lender portals have a separate field for "additional principal" — use it. Don't just increase the total payment amount in the regular payment field, as the lender may apply it differently.

- Check payments: Write "apply to principal" in the memo line and include a separate note with your payment specifying the amount to be applied to principal.

- Call your lender: Before making your first extra payment, call and confirm their process. Ask: "If I send an extra $200 with my payment, how do I ensure it's applied to principal?" Get the answer in writing if possible.

- Verify after payment: Check your next statement to ensure the extra amount reduced your principal balance. If your balance dropped by your regular principal amount PLUS the extra, it was applied correctly. If your next due date just moved forward, it wasn't.

Also check your loan agreement for prepayment penalties. Most conventional mortgages originated after 2014 don't have them (the CFPB's qualified mortgage rules effectively banned them), but some adjustable-rate, jumbo, and subprime loans from before that era might. A prepayment penalty could charge you 1%–3% of the remaining balance for paying off early — potentially $3,500–$10,500. Always verify before making large extra payments.

Extra Payments and PMI Removal

If you put less than 20% down, extra payments have a powerful secondary benefit: they help you reach the 80% loan-to-value (LTV) threshold needed to remove PMI faster.

On a $400,000 home with 10% down ($360,000 loan), PMI might cost $225/month. Through normal payments, you'd reach 80% LTV in about 7.5 years. With $200/month extra, you reach it in 5.5 years — saving 2 years of PMI ($5,400) on top of the interest savings ($19,800). That's $25,200 in combined savings from an extra $200/month.

Once you believe you've reached 80% LTV, contact your lender immediately to request PMI removal. Don't wait for automatic cancellation at 78% — that could cost you 6–12 extra months of PMI payments. For a complete guide on PMI, see our PMI calculator guide.

Common Mistakes to Avoid

- Starting too aggressively and burning out: Committing to $500/month extra when your budget is tight leads to stopping after a few months. Start with $100–$200 and increase gradually. Consistency beats intensity.

- Not designating payments as "principal only": As detailed above, if your lender applies extra to the next month's payment instead of principal, you lose most of the benefit. Always verify.

- Neglecting retirement savings: Your mortgage rate is probably 5%–7%. Historical stock market returns average 8%–10%. If you're not already contributing to retirement accounts (especially employer-matched ones), those should come first.

- Making extra payments on the wrong loan: If you have multiple debts, pay extra on the highest-rate debt first (the "avalanche method"). A car loan at 8.5% should be attacked before a mortgage at 6.5%.

- Forgetting the tax implications: Mortgage interest is tax-deductible if you itemize. By paying less interest through extra payments, your deduction shrinks. For most people, the savings still far outweigh the smaller deduction — but it's worth running the numbers with your tax advisor.

The bottom line: extra mortgage payments are one of the most powerful and underused financial tools available to homeowners. Whether you can afford $50 or $500 per month extra, the savings are real and substantial. Start wherever you can, automate it, and increase when possible. Use our mortgage calculator guide to run your own scenarios and see exactly how much you'll save.