15-Year vs 30-Year Mortgage: Which Is Right for You?

Table of Contents

- Side-by-Side Comparison

- Monthly Payment Differences at Every Price Point

- Total Interest: Where the Real Savings Are

- How Equity Builds Differently

- Pros and Cons of a 15-Year Mortgage

- Pros and Cons of a 30-Year Mortgage

- Who Should Choose Which?

- The Hybrid Approach: Best of Both Worlds

- Refinancing Between Terms

- Common Mistakes When Choosing a Term

Side-by-Side Comparison

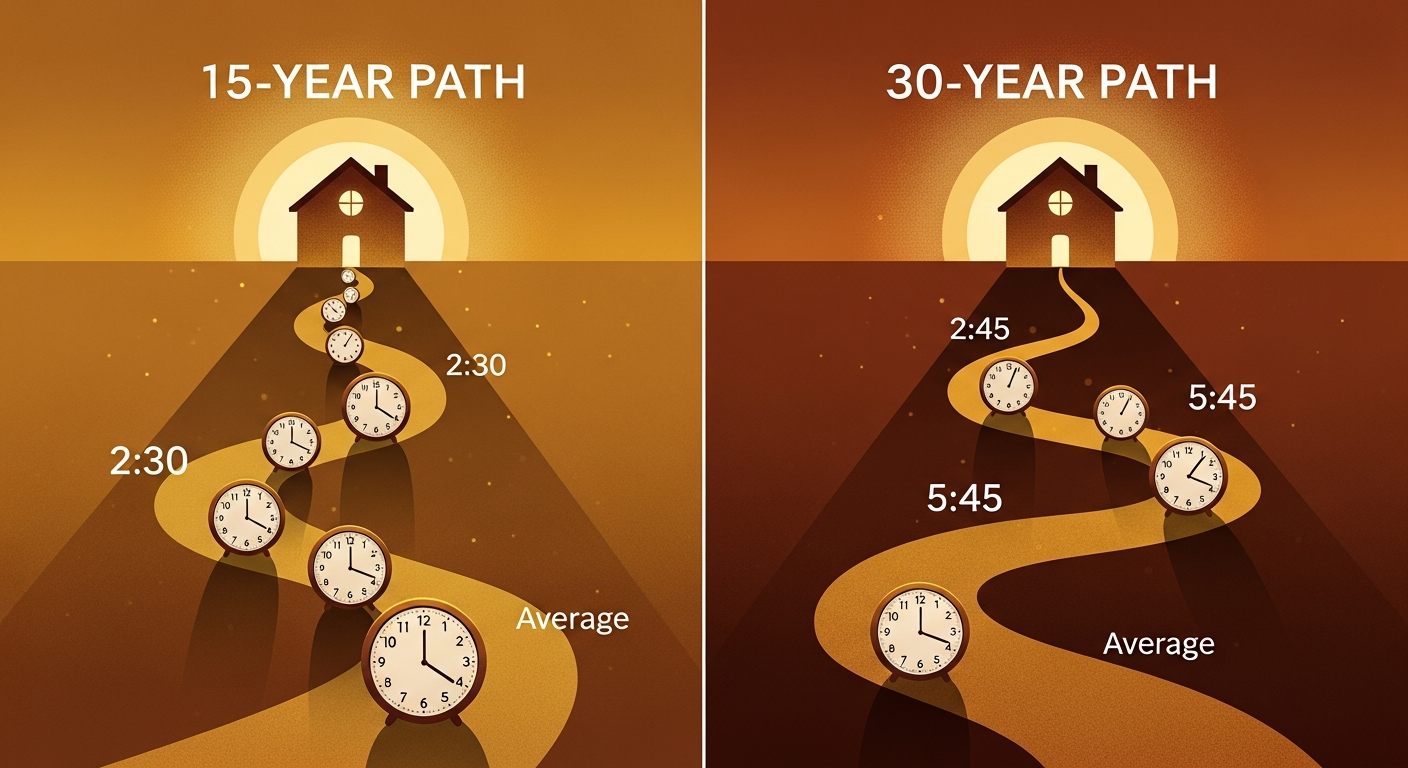

Choosing between a 15-year and 30-year mortgage is one of the most consequential financial decisions you'll make as a homeowner. The difference isn't just about monthly payments — it affects how much of your income goes to housing, how fast you build wealth, and when you'll be completely debt-free.

Let's start with a clear comparison. We'll use a $350,000 loan with 20% down on a $437,500 home. As of mid-2025, 15-year rates are typically 0.5%–0.75% lower than 30-year rates, according to Freddie Mac's Primary Mortgage Market Survey.

| Feature | 15-Year at 5.75% | 30-Year at 6.5% |

|---|---|---|

| Monthly P&I | $2,908 | $2,212 |

| Monthly difference | $696 more for 15-year | |

| Total interest paid | $173,440 | $446,320 |

| Interest savings | $272,880 saved with 15-year | |

| Payoff date | 2040 | 2055 |

| Total paid (P&I) | $523,440 | $796,320 |

The numbers are striking: the 15-year mortgage costs $696 more per month but saves nearly $273,000 in interest. You also own your home free and clear 15 years sooner. That rate advantage for 15-year loans has been consistent for decades — lenders offer lower rates because shorter loans carry less risk.

Monthly Payment Differences at Every Price Point

The biggest objection to a 15-year mortgage is the higher monthly payment. Let's see how this scales at different loan amounts so you can find your price range:

| Loan Amount | 15-Year at 5.75% | 30-Year at 6.5% | Difference |

|---|---|---|---|

| $200,000 | $1,661 | $1,264 | $397/mo |

| $250,000 | $2,077 | $1,580 | $497/mo |

| $300,000 | $2,493 | $1,896 | $597/mo |

| $350,000 | $2,908 | $2,212 | $696/mo |

| $400,000 | $3,324 | $2,528 | $796/mo |

| $450,000 | $3,739 | $2,844 | $895/mo |

| $550,000 | $4,570 | $3,476 | $1,094/mo |

For higher-cost homes, the monthly difference becomes substantial. On a $550,000 loan, you'd need an extra $1,094/month — that's a meaningful lifestyle impact that not every household can absorb comfortably. But at the $200,000–$300,000 level, the gap is much more manageable at $400–$600/month.

Here's a practical way to think about it: if the 15-year payment keeps your total housing costs (including taxes, insurance, and PMI if applicable) under 25% of your gross monthly income, the 15-year is financially comfortable. If it pushes you above 30%, the 30-year is the safer choice.

Total Interest: Where the Real Savings Are

The interest savings come from two sources: the lower rate AND the shorter term. Even if both loans had the exact same rate, the 15-year would save significantly because you're borrowing for half the time. But the rate discount makes it even more dramatic.

On our $350,000 example, total interest paid:

- 15-year at 5.75%: $173,440 (49.6% of loan amount)

- 30-year at 6.5%: $446,320 (127.5% of loan amount)

With the 30-year mortgage, you pay more in interest than the original loan amount — you're essentially paying for the house twice. With the 15-year, interest is less than half the loan. This is the single biggest financial argument for the shorter term.

Let's put $272,880 in savings into perspective. That money could:

- Fund four years of college tuition at a state university

- Buy an investment property outright in many markets

- Add $272,880 to your retirement nest egg

- Pay for 15+ years of new car purchases

For a deeper understanding of how interest accumulates over time, check our amortization schedule guide.

How Equity Builds Differently

Equity is the portion of your home you actually own — the difference between your home's value and what you still owe. The speed at which equity builds is dramatically different between the two terms.

After 5 years on a $350,000 loan:

- 15-year mortgage: Remaining balance of $242,300. You've built $107,700 in equity from payments alone (plus any appreciation).

- 30-year mortgage: Remaining balance of $322,400. You've built just $27,600 in equity from payments.

After 10 years:

- 15-year: Remaining balance of $111,200 — you own 68% of your home.

- 30-year: Remaining balance of $283,400 — you own just 19% of your home.

This equity difference matters enormously if you need to sell, refinance, or borrow against your home. With the 15-year mortgage, you have real financial flexibility within just a few years. With the 30-year, most of your early payments are going to the bank as interest, not building your wealth.

Pros and Cons of a 15-Year Mortgage

Pros:

- Save hundreds of thousands in interest. On a $350,000 loan, you save $272,880 — that's real money that stays in your pocket.

- Build equity much faster. After 10 years, you own 68% of your home versus just 19% with a 30-year.

- Lower interest rate. Typically 0.5%–0.75% less than 30-year rates, saving you money on every single payment.

- Own your home free and clear sooner. If you buy at age 35, you're mortgage-free by 50 instead of 65.

- Forced savings discipline. The higher required payment ensures you're building wealth whether you feel like it or not.

- Less risk of being underwater. Rapid equity building protects you if home values dip temporarily.

Cons:

- Higher monthly payment reduces cash flow. That extra $696/month can't go toward other goals.

- Less flexibility for other investments or expenses. If you lose your job, that higher payment is harder to cover.

- Harder to qualify. Lenders use the higher payment in DTI ratios, so you may qualify for less house.

- Less room for financial emergencies. Equity in your home isn't liquid — you can't easily spend it when the furnace breaks.

- Potential opportunity cost. That extra $696/month invested in the stock market at 8% average returns could theoretically grow to $250,000+ over 15 years.

Pros and Cons of a 30-Year Mortgage

Pros:

- Lower monthly payment = more breathing room. At $2,212 vs $2,908, you have an extra $696/month for other priorities.

- Easier to qualify for. The lower payment means a better debt-to-income ratio, potentially qualifying you for a larger loan.

- Extra cash for investing. The difference could go to retirement accounts, emergency savings, or other investments that may earn more than your mortgage rate.

- Maximum flexibility. You can always pay extra when you can afford it — but you're never locked into the higher amount.

- Better for uncertain income or early-career borrowers. If your income is growing but not yet stable, lower required payments reduce risk.

- Mortgage interest deduction. You pay more interest, which means a larger tax deduction if you itemize (though the benefit has shrunk with higher standard deductions).

Cons:

- Significantly more interest paid. $446,320 vs $173,440 — that's $272,880 more going to the bank.

- Slower equity building. After 10 years, you've only paid off 19% of the principal.

- Higher interest rate. You pay a premium for the longer term.

- 30 years of payments. Buy at 30, and you're paying until 60. Buy at 40, and you're paying until 70.

- Without discipline, the "extra" cash may get spent. Most people don't actually invest the difference — it just gets absorbed into lifestyle inflation.

Who Should Choose Which?

Choose a 15-year mortgage if:

- Your total housing payment (including taxes and insurance) stays under 25% of gross income. For a $350,000 loan with $500/month in taxes and insurance, that means you need at least $163,000 in gross annual income.

- You have a stable income and at least 6 months of expenses in your emergency fund.

- You're over 40 and want to retire mortgage-free. If you're 45 and take a 30-year mortgage, you'll be making payments until 75.

- You're already maxing out retirement contributions (401k, IRA) and have no high-interest debt.

- You value the guaranteed "return" of saved interest over potentially higher but uncertain investment returns.

Choose a 30-year mortgage if:

- The 15-year payment would exceed 28% of your gross income — you'd be stretching too thin.

- You're early in your career with expected income growth. Starting at $65,000/year with raises ahead? The 30-year gives you room to breathe now.

- You want maximum flexibility in your monthly budget for childcare, student loans, or starting a business.

- You're disciplined about investing the payment difference in retirement accounts or index funds.

- You have other high-interest debt that should be prioritized over extra mortgage payments.

- You plan to make extra payments anyway — getting the flexibility of a 30-year with the savings of accelerated payoff.

For help determining what you can comfortably afford, see our affordability guide.

The Hybrid Approach: Best of Both Worlds

Here's a strategy many financial planners recommend: take the 30-year mortgage but make payments as if it were a 15-year. This gives you the lower required payment (safety net) while building equity nearly as fast.

On our $350,000 example, take the 30-year at 6.5% (required payment: $2,212) but add $696 extra per month — matching the 15-year payment of $2,908. Here's what happens:

- Payoff time: About 16 years instead of 30

- Total interest: Roughly $196,000 (vs $446,320 with minimum payments)

- Interest saved: About $250,000

That's nearly as good as the 15-year mortgage ($173,440 in interest), but with the critical flexibility to drop back to the $2,212 minimum if you hit a financial rough patch — a job loss, medical emergency, or unexpected major expense.

The only downside: you won't get the lower 15-year interest rate (5.75% vs 6.5%), so you'll pay about $22,000 more in interest than a true 15-year. Many families find that trade-off worth it for the added peace of mind.

Making the Hybrid Approach Work

The hybrid strategy only works if you actually make those extra payments consistently. Here are tips to stay on track:

- Automate it: Set up automatic payments at the higher amount so you never have to think about it.

- Designate the extra as "principal only": Make sure your lender applies the additional amount to principal, not to future payments.

- Review annually: Each year, check whether you're on track for your target payoff date.

Learn more about how extra payments work in our extra payment savings guide.

Refinancing Between Terms

Your choice isn't permanent. Many homeowners start with a 30-year mortgage and refinance to a 15-year once their income increases or rates drop. Here's when refinancing makes sense:

- Rates have dropped significantly. If you locked in at 7% and rates fall to 5.5%, refinancing to a 15-year could give you a similar or even lower payment than your current 30-year — while cutting your remaining term in half.

- Your income has increased. A raise from $80,000 to $110,000 means the 15-year payment that was once a stretch is now comfortable.

- You've been in your home 5+ years. If you've already paid through the highest-interest years, refinancing resets the clock — but to a much shorter clock with a lower rate.

Example: You took a $350,000 30-year mortgage at 6.5% five years ago. Your balance is now $322,400. If you refinance to a 15-year at 5.5%, your new payment is $2,635. That's $423 more than your old payment — but you'll be mortgage-free in 15 years instead of 25, and save roughly $180,000 in remaining interest.

Factor in closing costs (typically $4,000–$8,000 for a refinance) and make sure you'll stay in the home long enough to recoup them. A rule of thumb: if you'll break even in under 3 years, the refinance is worth it.

Common Mistakes When Choosing a Term

After analyzing thousands of mortgage decisions, these are the most frequent errors we see:

- Only comparing monthly payments. The $696/month difference between 15 and 30 years seems like a lot — until you realize it costs you $272,880 in interest. Always look at total cost, not just monthly cost.

- Assuming you'll invest the difference. Studies show that most people who choose a 30-year "to invest the savings" don't actually invest it. The money gets absorbed into everyday spending. Be honest about your habits.

- Ignoring the rate difference. The 15-year doesn't just save you time — it saves you 0.5%–0.75% on the rate itself. That discount is free money.

- Stretching for a 15-year and having no emergency fund. A 15-year mortgage with zero savings is riskier than a 30-year with a healthy emergency fund. Financial security comes first.

- Not considering life stage. A 28-year-old buying their first home has different priorities than a 50-year-old planning for retirement. The right term depends on where you are in life, not just the math.

- Forgetting about other financial goals. If the 15-year payment means you can't contribute to your 401(k) match, you're leaving free money on the table. Always capture employer matches before accelerating your mortgage.

The bottom line: there's no universally "right" answer. The 15-year mortgage is the better mathematical choice for total cost. The 30-year mortgage is the better choice for flexibility and cash flow. Your job is to figure out which priority matters more for your specific situation.

Use a mortgage calculator to run both scenarios with your actual numbers — home price, down payment, and current rates. Seeing the exact dollars makes the decision much clearer than working with hypotheticals. And to understand the math behind these calculations, check our mortgage payment formula guide.